Finance careers are changing: are you ready?

The face of the finance┬ĀindustryŌĆ»is dramatically different today. Is an MBA worth it to help advance your career?

Getting an MBA is an important step for many careers ŌĆō especially those in the financial industry. No matter your ultimate career goals in finance, having an MBA will likely give you an advantage over others. While an MBA has always been useful for those pursuing finance careers, recent changes have made it even more important.

How finance is evolving:

There are several important ways in which finance careers are changing.

The use of technology

One of the biggest things impacting financial careers is evolving technology. There are multiple elements to this, including the rise of technology to handle traditional accounting tasks. One basic example is the evolution of tools that automatically complete complex calculations. These advanced tools, such as , simplify the financial professionalŌĆÖs workload by requiring only simple data input, rather than an in-depth understanding of how to manually complete the actual calculations. Such tools can significantly accelerate FP&A and even financial modeling work. On the more advanced end of the spectrum, there is the use of artificial intelligence to complete complex financial projections.

Big data also plays a significant role, with machine learning and AI allowing for automated complex analysis in addition to projections and calculations. This frees up time for those in finance to focus on other aspects of their career, including those traditionally left to more business-oriented roles.

The rise of e-commerce also encourages the move to digitization and an increased reliance on technology. Finance professionals need to be adept with understanding how to use automated billing platforms and gateways used for e-commerce businesses in particular.

While finance is not necessarily a client-facing role, there is typically at least a small element of human interaction, as people tend to be more comfortable talking to people than machines when discussing finances. Consider, for example, that a CFO must share his findings and insights with other C-suite executives. Alternately, a financial analyst will have to effectively communicate their analysis and recommendations with other members of the companyŌĆÖs team.

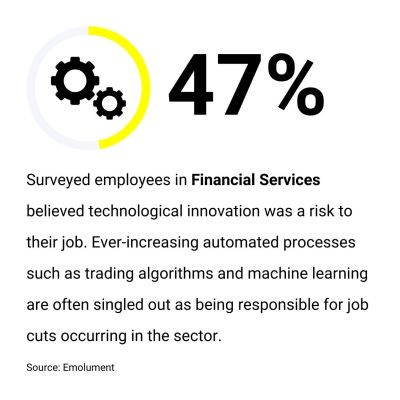

This need to effectively communicate deeper insights applies to internal finance roles in businesses, finance roles serving individuals, and external finance roles serving businesses. Even so, a 2017 study from found that 47% of employees in financial services believed technology was a risk to their job. An MBA will help you convert that risk into an opportunity.

All of these changes culminate to mean that employers now want finance professionals that understand the business as a whole instead of simply accounting in itself. They want tech-savvy finance professionals who are comfortable using technology and know-how to modernize a companyŌĆÖs existing infrastructure.

Some other impacts of technology on the financial sector include creating highly focused services, automating high-margin processes, and using data strategically.

It is clear that automation has affected finance by making some jobs obsolete. However, those jobs arenŌĆÖt necessarily lost as technology has replaced them by created new, alternate roles and responsibilities which often require the ability to provide deeper insights based on the available data. Data is now quite readily available, even excessively available, resulting in insights derived from that data becoming the new focus for finance professionals.

Increased automation of repetitive tasks has led to an increase in data interpretation in the world of finance. For example, reports that by 2030, automation may cause a loss of 30% of the current hours worked around the world. On the other hand, Cognizant listed 21 jobs that it predicts will be created from automation in its . Jobs most relevant to the financial sector include financial wellness coach and chief trust officer.

Finance roles shifting to business

Traditionally, a finance career and careers in accounting had significant overlap. Now, however, technology can take care of, or at least dramatically streamline and improve the efficiency of, those traditional accounting roles. This has led financial professionalsŌĆÖ roles to shift. Specifically, financial careers are beginning to more closely resemble careers in business, slowly becoming more of a business function than accounting.

As business skills and functions become more important for those in finance careers, having an MBA has become even more important than before. As a finance professional you need to be able to bridge gaps between marketing, HR and finance, you need to be able to understand the entire business value chain.

The future of finance is business partnership

Experts agree that the future of the finance function is likely found in business partnerships. With this role, you use finance to support strategy and decision-making. Instead of mathematical figures and accounting being the most important parts of the finance role, it is now how to strategically leverage those figures to benefit the company.

A closer look at finance and business partnering:

Business partnering can integrate with traditional financial roles, from accounting to compliance to advisory to control. Interestingly, business partnering is possible for every single person in finance, from CFOs to the newest employee.

An example of business partnering in a finance role is making sure that the company is using technology effectively and deriving real ROI from technology investments. Equally, understanding how digital marketing is impacting your business, how e-commerce can be used to increase sales.

An example in advisory is to look at data analysis to glean insights and make suggestions to resolve challenges and address opportunities. This ability to generate real-time data to inform rapid decision-making is key, as is the ability of a finance professional to understand how sales and marketing impact finance. As markets change and technology increases, financial careers require people who are capable of handling more variables than before. They must also be able to rapidly adapt to future changes, which requires critical thinking, analytical skills, and agility.

Pursing an MBA means that those in the finance industry will already understand and be ready to take on this role of business partnering.

Safra Catz, the current CEO and previous CFO of Oracle, has explained this previously, noting, ŌĆ£Historically, finance sat in the back seat, looking in the rearview mirror. ŌĆ£Where have we been? How much money did we make? What changed from last quarter?ŌĆØ The job of finance was to answer questions like those. With modern systems, looking backward is much easier, but so is looking forward. The systems calculate what happened in a very accurate way. Finance now rides shotgun; it is the navigator of the car. Yes, the line of business is driving, but finance is looking forward, suggesting routes to try out, and modeling new possibilities. You donŌĆÖt just extrapolate from the past; you are free to see what else is going on. This is a totally different job, partnered up with the lines of business.ŌĆØ

Maureen OŌĆÖConnell, the former CFO of Scholastic, also has some highly relevant insights. She said, ŌĆ£Just as organizations continuously evolve with the ever-changing global business climate, the role of a CFO is bound to change. A CFO needs to go beyond being ŌĆśthe finance operations expertŌĆÖ to become a corporate strategist who can enhance the firmŌĆÖs valuation and brand, and win over stakeholdersŌĆÖ trust and goodwill.ŌĆØ

How an MBA makes a difference in modern finance careers:

We already touched on why an MBA is so important in modern finance careers: With a shift to business partnerships, those in finance careers need to have the business skills and knowledge to fill this new role. Finance professionals need to be able to understand digital marketing functions and how technology development contributes to a companyŌĆÖs goals. They need to be able to bridge gaps between different teams from a finance perspective.

MBAs deliver a well-rounded business education

At its core, an MBA provides a well-rounded business education. This is the main way in which MBAs prepare those in finance for these business partnership responsibilities, as well as the other changing responsibilities of finance careers.

During an MBA program, students learn about a variety of skills that become increasingly important as they move up the financial career ladder. These skills may include:

┬Ę┬Ā┬Ā┬Ā┬Ā┬Ā Business strategy ┬Ę┬Ā┬Ā┬Ā┬Ā┬Ā Evaluating risks and opportunities ┬Ę┬Ā┬Ā┬Ā┬Ā┬Ā Marketing ┬Ę┬Ā┬Ā┬Ā┬Ā┬Ā Hiring ┬Ę┬Ā┬Ā┬Ā┬Ā┬Ā Adapting to challenging situations like financial crises ┬Ę┬Ā┬Ā┬Ā┬Ā┬Ā People management skills ┬Ę┬Ā┬Ā┬Ā┬Ā┬Ā Data analysis and data interpretation ┬Ę┬Ā┬Ā┬Ā┬Ā┬Ā Decision making

Depending on the MBA that you choose to pursue, you may also have the option to choose a specialization. For example, a specialization in Doing Business Across the World could prepare you to find jobs worldwide or evaluate geographic expansion opportunities for your company. Specializing in Enabling E-Commerce could help an MBA candidate apply their financial skills to businesses in e-commerce, a quickly growing industry.

MBAs help with time management

Pursing an MBA will also help significantly with your time management abilities. Some of this will come from the courses themselves but a lot of it will come from combining your daily life with an MBA. Most people now work while pursuing their online MBAs. You will have to fit in time for online classes, studying and completing assignments, and to network and take advantage of other career-building opportunities, while balancing your job responsibilities.

MBAs let you join any business

MBA graduates have the skills to succeed at any company. In addition to those already mentioned, the ability to gain practical skills in creating strategies, making presentations, constructing arguments, and researching are also important. In other words, being able to look beyond the numbers and understand what is driving those numbers to then make more informed decisions sets someone with an MBA apart.

Guy Kawasaki, one of the first Apple employees Has said, ŌĆ£An MBA is a great degree for career paths like investment banking, finance, consulting, and large companies.ŌĆØ

Keep in mind that major companies like Google, Deloitte, EY, Accenture, AT Kearney, and Microsoft hire the most MBAs. This means that your MBA could give you the opportunity to work at a major company. It also goes to show how in-demand your skills with an MBA are. Of these firms, you will notice that several, including AT Kearney, Ernst & Young, and Deloitte are in the financial sector.

MBAs have higher salaries

There is also the fact that when you have an MBA, you are better equipped to negotiate a higher salary. Part of this comes from the additional skills and education you have. It also comes from the fact that having an MBA makes you more likely to get a higher-level role in finance; those higher-level roles obviously come with higher salaries.

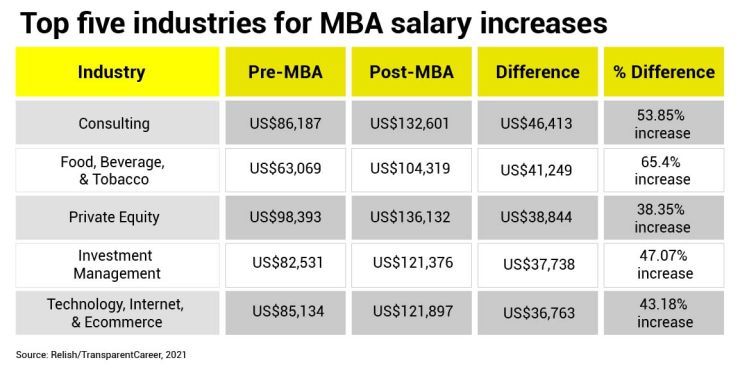

To put it in perspective, some estimates indicate that completing an MBA can increase your salary by $20,000 a year right after graduation. A study from and found that the salary increase for an MBA can be up to 53.85% and will likely be at least 16.72%.

Having an MBA makes you more likely to find a role in a higher-level position. Consider that Jeff Bezos of Amazon started in finance, as did Martha Stewart, Phil Knight (former Nike CEO), Randal L. Stephenson (AT&T CEO), John D. Rockefeller (former Standard Oil Company CEO), and Jeff Weiner (LinkedIn CEO).

MBAs help with networking

Coyne also points out the benefits of an MBA when it comes to networking. This largely comes from the vast alumni network that you become a part of when completing your MBA. More importantly, the people you share classes with as you complete your MBA will not all enter finance, which helps provide a diversity of networking connections. These connections increase even more when you complete an online MBA as your classmates and other alumni will be from around the world. At └Ūėč╔ńŪ°, our learners come from 75+ different countries and are employed at companies such as Google, Microsoft, EY, Boeing and Sterling Bank, this dramatically expands your network as well as the various insights you can glean from first-hand advice.

Those connections can serve multiple roles in the future. Coyne says, ŌĆ£ItŌĆÖs a great place to find new job opportunities, but also for general advice and help with whatever you might need.ŌĆØ

MBAs provide future flexibility

Even if you are currently sure that you want to pursue a career in finance for the rest of your life, that may change in the future. If it does, having an MBA will give you the flexibility you need to pursue another option. It will demonstrate to future employers in any industry that you have the relevant skills. Online MBAs also deliver the flexibility to continue working while you earn the degree, └Ūėč╔ńŪ° programs are specifically designed for working professionals.

It may even give you the knowledge and skills you need to start your own business. If you go that route, those networking connections you gained from your MBA will be particularly important.

The bottom line:

The expectations on professionals in financial roles are changing. The heavy influence of technology has shifted the role to include more business partnerships, which makes an MBA incredibly helpful for those pursuing finance careers. As a bonus, getting an MBA can help with networking, finding a job, and even any future career changes.

With less than 5% of the global population having earned an MBA, if you choose to pursue this degree, you will be one of the most educated people in the world. By being one of such a select few, your skills will help you stand out and advance your career.

Ready to take the next step? Learn more about our 100% online, affordable and high-quality MBA program with Specializations.

Fadl is Founder & CEO of └Ūėč╔ńŪ°. His vision is to enable greater social and economic mobility through high-quality, affordable education.

Join our newsletter and be the first to receive news about our programs, events and articles.